Nanny Payroll the Easy Way. Affordable and Simple.

The simplest and most affordable way to handle payroll for your nanny. Create and email payslips. Report Single Touch Payroll to the ATO. Calculate your taxes and super.

No set-up costs — just $9.95 per month.

Built for small Australian employers — just like your family!

No credit card required.

Trusted by 10,000+ Australian Employers

Employing a Nanny?

Congratulations! You've found the perfect nanny for your family — but now you're probably wondering what all your obligations are as an employer.

We know it can sound scary, but actually there's just a few simple things you need to do to register as an employer, and then you'll need to produce a payslip for your nanny every pay period and report the values to the ATO through Single Touch Payroll (STP).

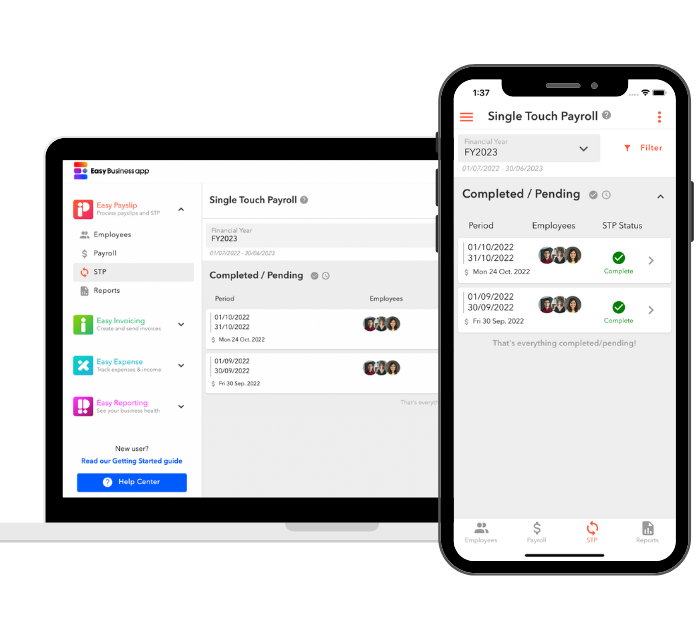

The good news is you can handle all this through Easy Business App — the absolute simplest solution for handling payroll. It only takes a few minutes to set up, and you can use it on any device — iPhone, Android phone, tablet or web browser on your laptop.

And it's the most affordable solution, too — saving you hundreds of dollars a year compared to managed nanny payroll services, and thousands compared to paying through an agency (where you'll be paying 10% GST on top of any salary!)

Easy Business App vs others

See for yourself how Easy Business App is the best option for your nanny payroll.

And up to 90% cheaper too.

| PayTheNanny | NannyPay | .png?width=50&height=50&name=Easy-Business-app-(rounded).png) |

|

| Initial Setup Charge | $75 | $165 | FREE |

| Monthly price | $56 | $114 |

|

| Pay your nanny weekly, fortnightly or monthly for the same price | ❌ | ❌ | ✔️ |

| Payslips and Single Touch Payroll (STP) | ✔️ | ✔️ | ✔️ |

| Automatically calculates correct withholding taxes and superannuation | ✔️ | ✔️ | ✔️ |

| Handle annual leave and leave payments | ✔️ | ✔️ | ✔️ |

| Easily add reimbursements and allowances | ✔️ | ✔️ | ✔️ |

| All payroll functionality on any device (phone, tablet, laptop) | ❌ | ❌ | ✔️ |

| Australia-based support: Telephone LiveChat |

✔️ ❌ ✔️ |

✔️ ❌ ✔️ |

✔️ ✔️ ✔️ |

| ATO-approved for STP | ✔️ | ✔️ | ✔️ |

Pricing correct as of 9 May 2023. NannyPay Basic ($57 per fortnight). PayTheNanny Monthly ($14 per week).

All the features you need

✅ Create, customise and email payslips — options for multiple rates, overtime, annual leave and more.

✅ Send Single Touch Payroll (STP) files to the ATO on any device in one tap. Web, mobile or tablet. We're STP Phase 2 compliant — the most recent version.

✅ Run simple reports — see easily how much withholding tax and super to pay with simple payroll reports.

✅ Share everything with your accountant and your other half. They can access your account (for free) to give you a hand and some peace of mind. We don't charge per user.

✅ Our local Australian support team is just a phone call, email or LiveChat away.

Get Started Today

Join the 10,000+ Aussie employers already using Easy Business App.

Get started today for free.

What our Customers Say

Barb

Owner, Sports Power

Armadale, WA

“Very easy to use and does the job for employees and the ATO. The Help Desk is AMAZING!!"

Mark

Owner, MD Painting Services

Perth, WA

"Easy Payslip saves me so much time...I just put the figures in and it does it for me!"

Claudio

Director, Stay Bonanza

Seaholme, VIC

"The company name says it all - it's easy to use, and they offer excellent customer service."

John

Owner, Choice Automotive Repairs

Kogarah, NSW

“The best thing is their Mobile App, It's brilliant! And nothing beats their Aussie customer service!"

Suzi

Owner, Gents & Rascals

Maroubra, NSW

"It's a two-second job doing payslips and STP! The app saves me hours of spreadsheets and data entry."

Pricing

Using Easy Payslip to handle your nanny's payroll is the most affordable option on the market.

No annual commitment, no lock-in contracts.

Just $9.95 per month

Frequently Asked Questions

Don't I need to use a specialist nanny payroll company?

No.

Of course, you absolutely can and for some families that is the right choice. They'll help get you set up with the ATO and sort out your Worker's Compensation Insurance. Alternatively, some will operate as a 'co-employer' of your nanny, which means they assume some of the reporting obligations.

But these services can be very expensive, often charging many hundreds of dollars in setup fees, and $100+ per month to process your payroll (versus our $8.80 per month charge).

Your obligation as an employer may be a lot more straight-forward than you realise. See the next question...

What are my obligations as an employer of a nanny?

One-Time Setup Activities

You will need to register with the ATO as an employer to receive a Withholding Payer Number (WPN) — it's just one simple form.

You'll also need Workers Compensation Insurance — providers vary state-by-state, but again, it's a one-time setup activity and an annual insurance premium. (Hint: the cost is about $175 per year in NSW),

You'll need a contract with your nanny too; this is to protect both parties and make sure everyone knows where they stand. There's a simple template available at the end of this article.

Every Pay Period

On a weekly/fortnightly/monthly basis you'll need to create payslips to send to your nanny and lodge Single Touch Payroll with the ATO. Easy Business App allows you to do that in a couple of taps.

Quarterly Activities

You'll need to pay the ATO your withheld tax (PAYG) on a monthly or quarterly basis. Our reports make it easy to calculate this amount, and you can simple pay it through the ATO online portal for free.

And finally, you'll need to pay super to your nanny's nominated super fund on a quarterly basis — again, this can be handled really easily (and for free) through the ATO portal via the Small Business Superannuation Clearing House.

Are all features available during the 30-day free trial?

Yes, all features are available. Add your nanny's details, send payslips, even send STP files to the ATO.

Do I need to manually register the software with the ATO?

No.

Unlike most of our competitors, we handle the ATO software registration automatically when you submit your first STP file, so it's one less thing for you to have to worry about.

What if I need to share my account, for example with my partner?

You can easily share access to your Easy Payslip account with your partner or accountant. Simply go to ‘My Organisation’ in the app and click ‘Invite Member’ - you can invite users to access reports or even run payroll and submit STP on your behalf.

Unlike some of our competitors, we don't charge for additional users.

Do lots of employers use Easy Business App for payroll?

Yes!

We have processed over $1 billion of payroll for small employers in Australia.

Most of our users are sole-traders or micro-businesses, often with just one employee. And we have families all across Australia using us to pay their nannies, too.

It may feel like paying a nanny is somehow "different" or "special", but actually, the processes you follow are exactly the same as your plumber is following with his apprentice.

Well, it's actually a bit simpler because you don't need an ABN. Hooray!

Can I trust you with my data?

Yes.

We take data security incredibly seriously. We are ISO 27001 certified — the world's premier independently-audited security certification — and all your data is stored securely using best-in-class encryption right here in Australia.

We're also an ATO-approved Digital Services Provider (DSP).

You should be wary of using software from companies that are not ISO 27001 certified for sensitive data (like payroll).

.png?width=812&height=188&name=Easy-Business-app-(colour).png)